It's Simcoe Day / Civic Holiday in most of Canada, when the workers rest (thank you John Graves Simcoe! / thank you Civic!). So we decided to take it slowly (and not only because HNU could not be traded just when natural gas decided to go crazy) and did some quiet reading.

Here's what we learned from Niall Ferguson's

The Cash Nexus: Economics And Politics From The Age Of Warfare Through The Age Of Welfare, 1700-2000.

Karl Marx wrote to his long-time comrade

Friedrich Engels in June 1864:

The time has come again when, with wit and very little money, it's possible to make money in London.

According to a recent biographer, Karl may have been tempted to become a day-trader by the German socialist Ferdinand Lassalle, who had boasted of his stock market speculations.

A spectre is haunting the stock markets. What's the deal with all these socialists using tools of the decadent capitalism you may ask, with good (if a bit naive) reason. The key, which will surprise you not a little, may be found in a letter Karl wrote to Lion Philips, also in the summer of that year:

I have, which will surprise you not a little, been speculating — partly in American funds, but more especially in English stocks, which are springing up like mushrooms this year (in furtherance of every imaginable and unimaginable joint stock enterprise), are forced up to quite an unreasonable level and then, for the most part, collapse. In this way, I have made over £400 and, now that the complexity of the political situation affords greater scope, I shall begin all over again. It's a type of operation that makes demands on one's time, and it's worth while running some risk in order to relieve the enemy of his money.

The unbearable lightness of trading. And, of course, relieving the enemy of his money. If only he'd made a killing on the stock markets, history may have been different. Marx Financials Inc. could have been today too big to fail... But nothing of consequence happened.

Finally, we read in the

Marx & Engels Internet Archive that Engels wrote Marx in 1852, in a hopeful (if a bit naive) spirit:

The minor panic in the money market appears to be over, consols and railway shares are again rising merrily, money is easier, speculation is still pretty evenly distributed over corn, cotton, steam boats, mining operations, etc., etc. But cotton has already become a very risky proposition; despite what is so far a very promising crop, prices are rising continuously, merely as a result of high consumption and the possibility of a brief cotton shortage before fresh imports can arrive. Anyway I don't believe that the crisis will this time be preceded by a regular rage for speculation; if circumstances are favourable in other respects, a few mails bringing bad news from India, a panic in New York, etc., will very soon prove that many a virtuous citizen has been up to all kinds of sharp practice on the quiet. And these crucial ill-tidings from overstocked markets must surely come soon. Massive shipments continue to leave for China and India, and yet the advices are nothing out of the ordinary; indeed, Calcutta is decidedly overstocked, and here and there native dealers are going bankrupt. I don't believe that prosperity will continue beyond October or November — even Peter Ermen is becoming worried.

Regretfully, no

favourable circumstances yet. As we well know, just cyclical business as usual...

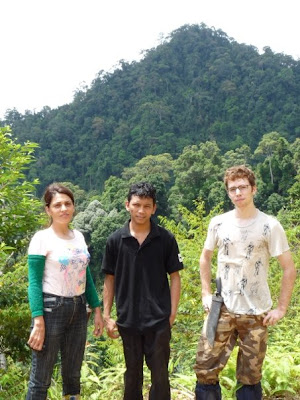

Jeep for hanging jungle apparel out to dry — free. Provided courtesy of WWF.

Jeep for hanging jungle apparel out to dry — free. Provided courtesy of WWF. Parang — MYR 30. Great for cutting through the dense foliage. Keep in mind that the rattan, with its thorny vines that cling and drag into your skin, may be too thick for the regular parang, at least in the hands of the less adept user.

Parang — MYR 30. Great for cutting through the dense foliage. Keep in mind that the rattan, with its thorny vines that cling and drag into your skin, may be too thick for the regular parang, at least in the hands of the less adept user. Bathing with the elephants — priceless...

Bathing with the elephants — priceless...